Fixed Income Portfolio Duration . Most bond investors know that interest rate changes can affect the value of their fixed income holdings. plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see at a glance the weighted average duration of your fixed. Pure, or macaulay duration, is. Using the weighted average of time to receipt of the aggregate. Convexity supplements duration as a measure of a. there are two methods to calculate the duration and convexity of a bond portfolio: It’s a simple summary statistic of the effective average maturity. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. These many factors are calculated into one number. How a bond or bond portfolio’s value is. duration is a way of measuring the interest rate risk of an individual or portfolio of fixed income securities.

from cma.wolflinecapital.com

Convexity supplements duration as a measure of a. It’s a simple summary statistic of the effective average maturity. duration is a way of measuring the interest rate risk of an individual or portfolio of fixed income securities. Pure, or macaulay duration, is. How a bond or bond portfolio’s value is. Using the weighted average of time to receipt of the aggregate. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. These many factors are calculated into one number. there are two methods to calculate the duration and convexity of a bond portfolio: plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see at a glance the weighted average duration of your fixed.

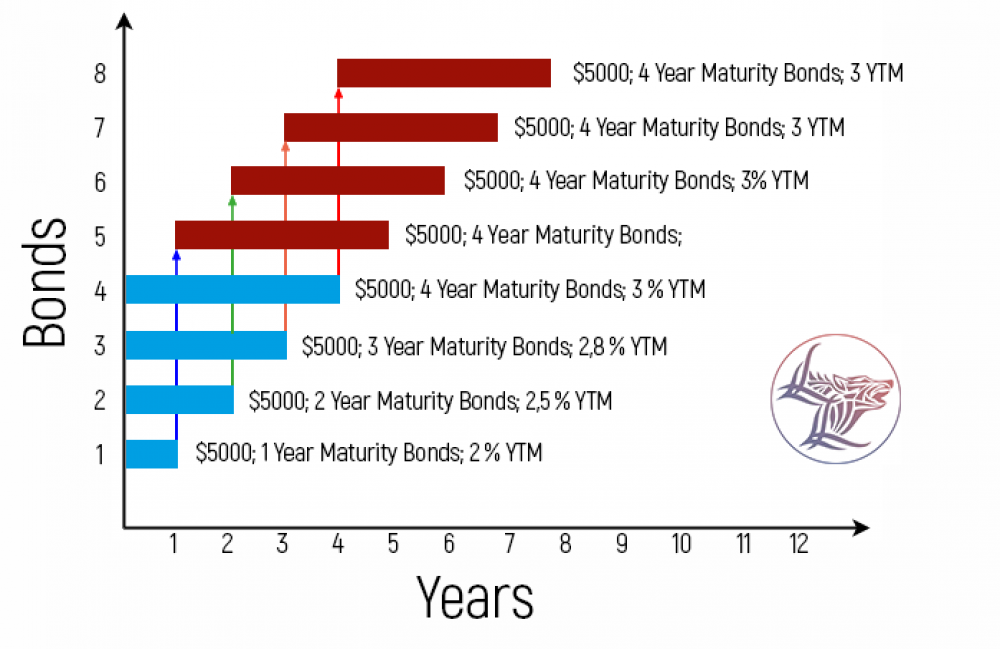

Securing Portfolio with Bond Ladder Strategy Wolfline

Fixed Income Portfolio Duration How a bond or bond portfolio’s value is. These many factors are calculated into one number. there are two methods to calculate the duration and convexity of a bond portfolio: Pure, or macaulay duration, is. duration is a way of measuring the interest rate risk of an individual or portfolio of fixed income securities. Convexity supplements duration as a measure of a. Most bond investors know that interest rate changes can affect the value of their fixed income holdings. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. How a bond or bond portfolio’s value is. Using the weighted average of time to receipt of the aggregate. plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see at a glance the weighted average duration of your fixed. It’s a simple summary statistic of the effective average maturity.

From www.youtube.com

Fixed 11 Portfolio Risk Management with Duration Matching YouTube Fixed Income Portfolio Duration plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see at a glance the weighted average duration of your fixed. It’s a simple summary statistic of the effective average maturity. Using the weighted average of time to receipt of the aggregate. Pure, or macaulay duration, is. duration is a way of. Fixed Income Portfolio Duration.

From www.scribd.com

Revision of The Portfolio PDF Bond Duration Bonds Fixed Income Portfolio Duration Pure, or macaulay duration, is. How a bond or bond portfolio’s value is. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. Convexity supplements duration as a measure of a. Using the weighted average of time to receipt of the aggregate. Most bond investors know that interest rate. Fixed Income Portfolio Duration.

From www.advisorperspectives.com

Key Takeaways From Our 2021 Advisor Fixed Portfolio Review Fixed Income Portfolio Duration Pure, or macaulay duration, is. there are two methods to calculate the duration and convexity of a bond portfolio: Most bond investors know that interest rate changes can affect the value of their fixed income holdings. How a bond or bond portfolio’s value is. duration is a way of measuring the interest rate risk of an individual or. Fixed Income Portfolio Duration.

From blog.rurashfin.com

How to Create a Modern Portfolio? The Asset Allocation way Fixed Income Portfolio Duration These many factors are calculated into one number. How a bond or bond portfolio’s value is. Pure, or macaulay duration, is. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see. Fixed Income Portfolio Duration.

From www.slideserve.com

PPT Chapter 5 PowerPoint Presentation, free download ID4258851 Fixed Income Portfolio Duration there are two methods to calculate the duration and convexity of a bond portfolio: These many factors are calculated into one number. Convexity supplements duration as a measure of a. It’s a simple summary statistic of the effective average maturity. plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see at. Fixed Income Portfolio Duration.

From www.etftrends.com

Short Duration Fixed Model Portfolio Keep the Lose the Fixed Income Portfolio Duration Using the weighted average of time to receipt of the aggregate. How a bond or bond portfolio’s value is. duration is a way of measuring the interest rate risk of an individual or portfolio of fixed income securities. there are two methods to calculate the duration and convexity of a bond portfolio: Convexity supplements duration as a measure. Fixed Income Portfolio Duration.

From bondwave.com

BondWave Fixed Investment Software and Bond Trading Tools Fixed Income Portfolio Duration Convexity supplements duration as a measure of a. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see at a glance the weighted average duration of your fixed. duration is. Fixed Income Portfolio Duration.

From www.slideserve.com

PPT Chapter 16 Revision of the Portfolio PowerPoint Fixed Income Portfolio Duration It’s a simple summary statistic of the effective average maturity. plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see at a glance the weighted average duration of your fixed. duration is a way of measuring the interest rate risk of an individual or portfolio of fixed income securities. there. Fixed Income Portfolio Duration.

From www.scribd.com

Chapter 16 Fixed Portfolio Management PDF Bond Duration Fixed Income Portfolio Duration duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. How a bond or bond portfolio’s value is. Most bond investors know that interest rate changes can affect the value of their fixed income holdings. It’s a simple summary statistic of the effective average maturity. Convexity supplements duration as. Fixed Income Portfolio Duration.

From www.investopedia.com

Duration Definition and Its Use in Fixed Investing Fixed Income Portfolio Duration Using the weighted average of time to receipt of the aggregate. It’s a simple summary statistic of the effective average maturity. How a bond or bond portfolio’s value is. Most bond investors know that interest rate changes can affect the value of their fixed income holdings. duration is a way of measuring the interest rate risk of an individual. Fixed Income Portfolio Duration.

From www.scribd.com

Fixed Portfolio Performance Attribution PDF Bond Duration Fixed Income Portfolio Duration duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. Convexity supplements duration as a measure of a. Most bond investors know that interest rate changes can affect the value of their fixed income holdings. It’s a simple summary statistic of the effective average maturity. plot the duration. Fixed Income Portfolio Duration.

From imgbin.com

Fixed Market Risk Portfolio Yield Curve PNG, Clipart, Area, Bond Fixed Income Portfolio Duration Using the weighted average of time to receipt of the aggregate. there are two methods to calculate the duration and convexity of a bond portfolio: It’s a simple summary statistic of the effective average maturity. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. Most bond investors. Fixed Income Portfolio Duration.

From financinglife.org

Fixed Examples Ballast to stabilize the portfolio Fixed Income Portfolio Duration there are two methods to calculate the duration and convexity of a bond portfolio: duration is a way of measuring the interest rate risk of an individual or portfolio of fixed income securities. plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see at a glance the weighted average duration. Fixed Income Portfolio Duration.

From www.scribd.com

Portfolio Management PDF Bond Duration Bonds (Finance) Fixed Income Portfolio Duration there are two methods to calculate the duration and convexity of a bond portfolio: Using the weighted average of time to receipt of the aggregate. It’s a simple summary statistic of the effective average maturity. How a bond or bond portfolio’s value is. Most bond investors know that interest rate changes can affect the value of their fixed income. Fixed Income Portfolio Duration.

From insight.factset.com

Fixed portfolio optimization now offered through Axioma Fixed Income Portfolio Duration How a bond or bond portfolio’s value is. Most bond investors know that interest rate changes can affect the value of their fixed income holdings. plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see at a glance the weighted average duration of your fixed. duration is a measurement of a. Fixed Income Portfolio Duration.

From slidetodoc.com

Introduction to Fixed portfolio management Convexity strategies Fixed Income Portfolio Duration Pure, or macaulay duration, is. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and call features. duration is a way of measuring the interest rate risk of an individual or portfolio of fixed income securities. How a bond or bond portfolio’s value is. It’s a simple summary statistic of. Fixed Income Portfolio Duration.

From perspectives.agf.com

5 facts about fixed AGF Perspectives Fixed Income Portfolio Duration there are two methods to calculate the duration and convexity of a bond portfolio: Convexity supplements duration as a measure of a. Pure, or macaulay duration, is. duration is a way of measuring the interest rate risk of an individual or portfolio of fixed income securities. It’s a simple summary statistic of the effective average maturity. These many. Fixed Income Portfolio Duration.

From www.2020financialplanningllc.com

Examples of Fixed Portfolios Fixed Income Portfolio Duration Convexity supplements duration as a measure of a. Pure, or macaulay duration, is. plot the duration of your fixed income holdings using fidelity's guided portfolio summary sm (gps) to see at a glance the weighted average duration of your fixed. duration is a measurement of a bond’s interest rate risk that considers a bond’s maturity, yield, coupon and. Fixed Income Portfolio Duration.